The Equitable Asset Management Group (EAMG) is responsible for a lineup of actively managed segregated funds including three balanced funds, a bond fund and a money market fund. Our portfolio lineup is designed for a wide range of investor preferences, offering various risk-return profiles to serve our clients’ investment strategies. To achieve our desired equity exposures, the Active Balanced Portfolios utilize Canadian and U.S. listed exchange traded funds (ETFs).

Exchange traded funds

ETFs are investment vehicles that seek to replicate the performance of underlying indexes. The proliferation of the Canadian and U.S. ETF markets enables our team to achieve targeted positions in specific country, factor, and/or sectors within global equity markets. These products offer a high degree of liquidity at a low cost while reducing single-stock concentration risk.

Active Balanced Portfolios

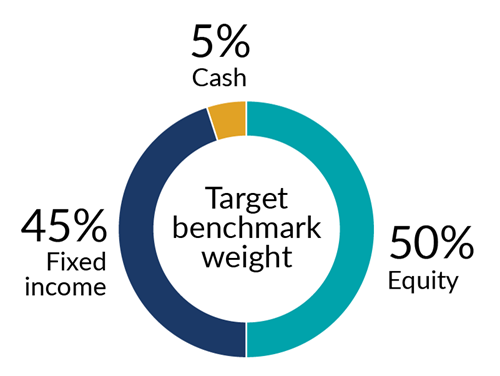

Equitable Life Active Balanced Income Fund

The “Income Fund” offers the highest exposure to fixed income and the least amount of exposure to equities. This fund is ideal for investors targeting current income with capital appreciation and preservation.

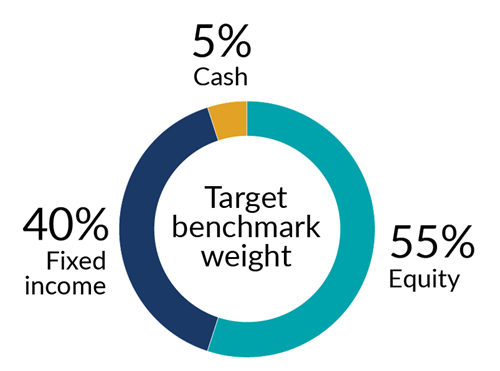

Equitable Life Active Balanced Fund

The “Balanced Fund” offers a moderate mix between equities and fixed income. This fund is ideal for investors desiring growth of principal in addition to income.

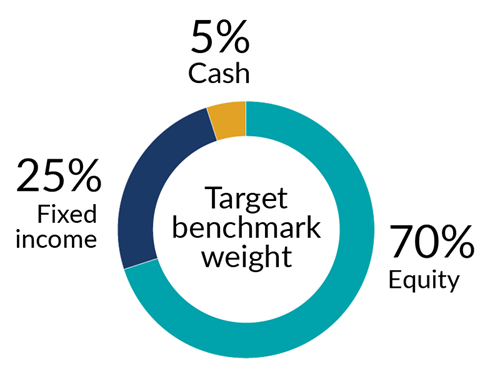

Equitable Life Active Balanced Growth Fund

The “Growth Fund” offers the highest exposure to equities and the least amount of exposure to fixed income. This fund is ideal for investors targeting capital appreciation.

Equitable Life Active Canadian Bond Fund

The “Bond Fund” offers exposure to a diversified portfolio of primarily Canadian dollar fixed income securities, including government bonds and investment grade corporate debt. This fund is ideal for investors targeting current income above money market rates.

Learn about our investment approach

Explore the benefits of choosing Equitable