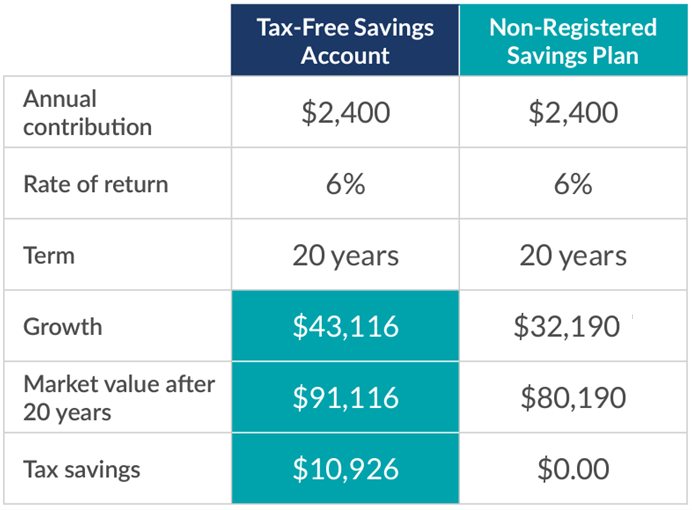

A Tax-Free Savings Account (TFSA) helps you save more and reach your goals faster. For example, if you put $200 into a TFSA every month for 20 years, you will have saved $48,000 and earned $43,116 tax-free*. Compared to a taxable account, you save an extra $10,926.*

*Assumes annual tax on non-registered savings is paid from the account value. Based on a $200 monthly contribution for 20 years and a 6% return. Assumes a 20% average tax rate on investment income (40% interest, 30% dividends, 30% capital gains) for a middle-income earner.

TFSA Benefits

A TFSA is flexible and useful for most Canadians. You can save for:

- Home renovations

- A vehicle

- A family trip

- Emergency savings

- Retirement

A TFSA can also be an income source during retirement. Those expecting to be in the same or higher tax bracket in retirement often use a TFSA. Unlike a Registered Retirement Savings Plan (RRSP), a TFSA doesn’t need to be converted to an income product at age 71, making it ideal for retirees wanting tax-free savings. TFSA income doesn’t affect eligibility for:

- Old Age Security,

- Guaranteed Income Supplement,

- Goods and services tax (GST) credit, or

- Other income tested benefits and tax credits.

You can withdraw from your TFSA and redeposit the same amount the next year. For example, if you withdraw $5,000 in November, you can add $5,000 to your contribution room in January. Withdrawals can be redeposited later.

TFSA assets can be transferred to your spouse upon death without affecting their TFSA or contribution allowance. The surviving spouse gets tax-sheltered assets, which can be passed on to their estate or beneficiary tax-free.

If your child might not attend post-secondary education, a TFSA is a good alternative to a Registered Education Savings Plan. However, a TFSA doesn’t include government contributions like the Canada Education Savings Grant.

Talk to your advisor to see if a TFSA can help you achieve your goals.