Pivotal Select Estate Class (75/100) and Pivotal Select Protection Class (100/100) guarantee options include a 100% death benefit guarantee. With a 100% death benefit, if you die, all deposits made to the policy are guaranteed dollar-for-dollar, even if the market value of your policy has declined1. Guarantees can also help you to feel more comfortable about staying invested during periods of volatility, knowing the guarantee has your investment protected. If you happen to die during a time when the market value of your policy is down, the death benefit guarantee ensures your beneficiaries receive the guaranteed value or the current market value – whichever is greater.

To further enhance your death benefit guarantee, Pivotal Select allows you to lock in market growth with the option of annual resets of the death benefit guarantee. When your policy has increased in value, a reset of the death benefit guarantee allows you to increase your guarantee to 100% of the current market value and lock in the growth of your investment.

You can choose to reset once a year2 at any time, giving you the opportunity to protect investment gains within your policy.

A 100% death benefit guarantee protects a legacy for your beneficiaries, and resets allow you to protect the value of your deposits and lock in investment growth along the way. The death benefit guarantee is designed to help give you confidence to stay invested through periods of market volatility.

A case study

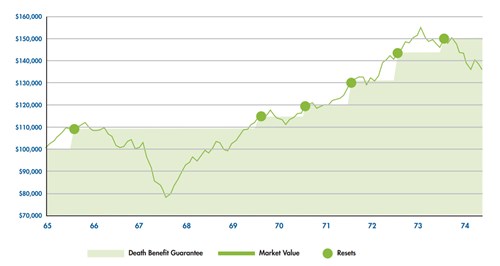

Cindy invested $100,000 into a policy with a 100% death benefit guarantee and annual reset option in July 2024 (age 65). Cindy meets with her advisor every February to review her financial plan and to conduct a reset of her death benefit guarantee if the market value has increased.

By age 74, Cindy has increased the amount guaranteed to her beneficiaries to over $150,000, representing more than 150% of her initial investment. Cindy’s death benefit guarantee3 gives her peace of mind when the value of her investment declines, knowing her investment is protected by the guarantee. She could take added comfort in knowing that, if she died, her beneficiaries would be guaranteed to receive at least this amount, regardless of what her investment is currently worth.

¹ Any withdrawals or fees paid from the policy will reduce the guaranteed benefits and the contract value.

2 Annual resets are permitted up to the annuitant’s 80th birthday. See your Contract and Information Folder for more information on resets and guarantees.

3 The death benefit guarantee is applied upon the death of the annuitant. See the Contract and Information Folder. For illustration purposes only. Performance histories are not indicative of future performance. Market value is based on the net return of a $100,000 initial investment in the Equitable Life Bissett Dividend Income Fund from July 2006 to December 2015.

® denotes a trademark of The Equitable Life Insurance Company of Canada.